Message me in CHAT any individual stocks you have or are watching for

- TERMINOLOGY: ES = S&P Futures; YM = DOW Futures; NQ = Nasdaq Futures

️

️ ️

️ ️ Challenge: www.32trades.com/200-trade-

️ Challenge: www.32trades.com/200-trade-

3yr, 5yr, & 7yr yield curves have inverted compared to the 10yr

This means short term return is more valuable than long term: it statistically increases odds of a recession

But the most definite sign is to watch for 2yr vs 10yr. Currently its difference is razor thin at +0,14

That noted, the

-1.28% dip yesterday after Powell said he’d raise rates higher faster if he had to does not fir the “POST OPEX WEEK DIP” expectation, but did produce the now clear SELL DIVERGENCES on the shorter time frames on the 4 indexes

SPX 1Hr:

Divergences are divergences until they aren’t and NEGATIVE ONES are easier to negate than POSITIVE ONES as I shared last week when the RIP YOUR FACE OFF MOVE was expected

With how we’ve retraced 50% of the +50 session correction, the LOW ODDS BEAR B BOUNCE TOP must be noted, but not focused on

I can only see Putin nuking Dnipro, Ukraine to create a WALL as the only way this comes into play for SPX 3840 – 3730

So its MADE AWARE OF, but not something to go jumping into as it would still be a better LONG ENTRY than anything more than a GAMBLE HEDGE

I still see us in the wave 3 of 1 completing/completed up here at this 4466.64 and the wave 4 of 1 retrace to 4359 – 4322 reasonable to expect before the next move higher with the type of energy that we’ve been made to expect.

SPX gained

+7.69% to yesterday’s 4481.75 and again that dip of -1.28% hardly seems legit considering the WEIGHT NAMES and their smaller weighted cousins having gained 20-50% last week into yesterday

-

TSLA +24.88%

-

AMZN +15.25%

-

GOOGL +9.01%

-

AMD +17.25%

-

NVDA +29.37% (Investor day today)

-

MSFT +9.61%

-

SHOP +40.62%

-

SQ +53.68%

-

SNAP +30.76%

-

TWTR +20.52%

-

ROKU +28.98%

-

PTON +31.94%

-

FB +17.26%

-

AAPL +11.70%

-

NFLX +15.63%

-

BABA +56.84%

This is the last 5 sessions only

SPX PROBLEMS ABOVE:

-

4,489.55

-

4,481.75

-

4,475.01

-

4,472.77

-

4,471.07

SPX TARGETS BELOW NOT PASSING THE FOMC LOW:

-

4406.22

-

4395.11

-

4359.50

-

4341.52

-

4321.84

-

4298.20

BUY THIS DIP WHEN IT DIPS WITH MAR 31/APR 1 CALLS

or SELL PUTS CREDIT SPREADS

We’re GREEN for the month of March by

2.25% (4,363.14) and as shared all last week and prior week, seeing 3 RED MONTHS is unheard of so

The FOMC LOW last week is 4,251.99 0 well BELOW those 6 lower pivot targets for this dip

From 4481.75, a

-3% dip is 4347.30 and fits for a 38.2 retrace between the CORRECTION LOW (4114.65) and Last Week’s Low (4161.72)

It’s  Tuesday with all the chatter today to be the INVERTED CURVE

Tuesday with all the chatter today to be the INVERTED CURVE

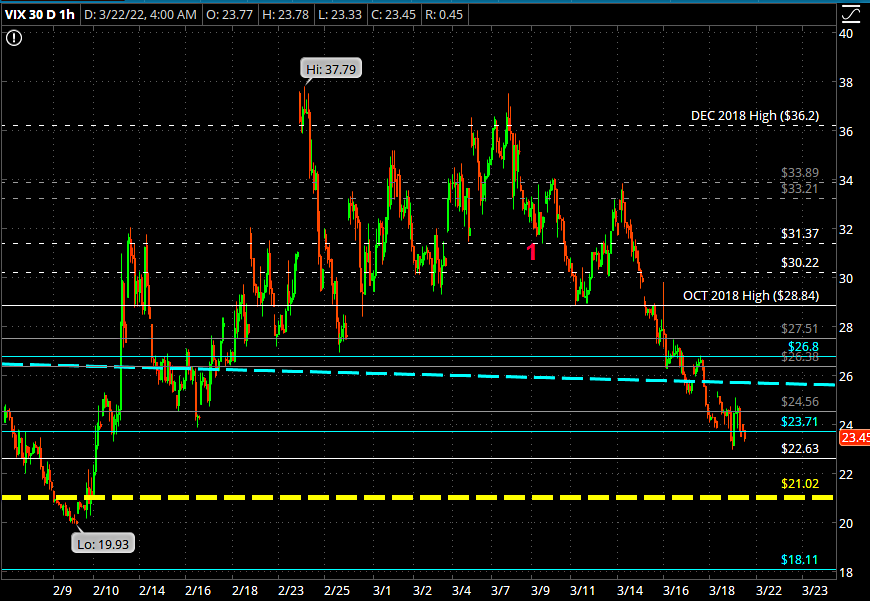

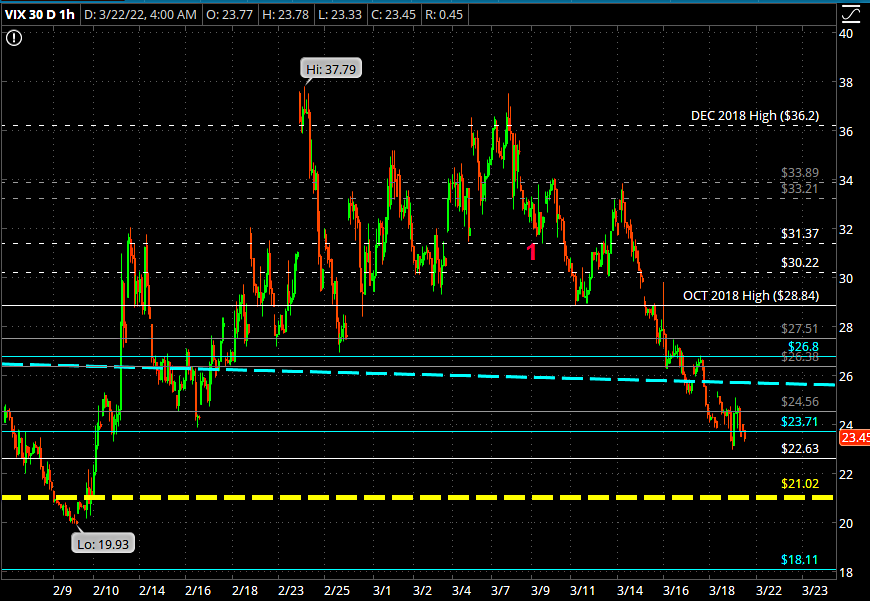

DIP, not DUMP and we’re still watching for that VIX 21.02 to trigger a SELL ALGO which will be matched with a headline for sure

Tuesday with all the chatter today to be the INVERTED CURVE

Tuesday with all the chatter today to be the INVERTED CURVE

Message me in chat/email any tickers you want looked at

——————————

![]() 10yr @ 2.348 (5:00 AM)

10yr @ 2.348 (5:00 AM)

![]()

![]() VIX @ 23.42 (5:00 AM)

VIX @ 23.42 (5:00 AM)

SPX Monday MAR 21 Data:

SPX Monday MAR 21 Data:

- Overnight Gap: -0.72

- Range: 57.45

- Open -Close: -1.22

- Close -Close: -1.94

- LOD > Previous Close: -38.82

- Previous Close > High: +18.63

- ATH > Close: -7.42%

- ATH > LOD: -8.18%

- 2022 Open: 4778.14 (-6.63%)

- HOD Off MAR 2020 LOW: +104.47%

- YoY: +13.21%

- Month of March (4,363.14): +2.25%