Message me in CHAT any individual stocks you have or are watching for

- TERMINOLOGY: ES = S&P Futures; YM = DOW Futures; NQ = Nasdaq Futures

️

️ ️

️ ️ Challenge: www.32trades.com/200-trade-

️ Challenge: www.32trades.com/200-trade-

QUAD WITCHING FRIDAY’S:  TREND

TREND

DEC 17 2021

DEC peaked on 16 (4731.99) and dropped into Monday after OPEX (4531.10)

- -4.25%

SEP 17 2021

32tim 15 hours ago

32tim 15 hours ago

SEP 2 2021 PEAKED (4545.85) as you already know due to being the same date as the SEP 2020 PEAK: “2”

SEP BOTTOM came Monday after OPEX: -5.28% from SEP 2 ATH

- –3.70% from QUAD OPEX Friday High

JUN 18 2021

JUN 15 (OPEX Tuesday) we finally posted the ATH 4257.16

QUAD Friday OPEX was the LOW: -2.17%

MAR 19 2021

ATH posted OPEX Wednesday (3983.87) and the POST OPEX WEEK LOW came the Thursday (3853.50) -3.27%

DEC 18 2020

32tim 15 hours ago

QUAD Friday is when the ATH posted: 3726.70

Monday POST OPEX Week was the dip bottom: 3636.48 -2.42%

32tim 15 hours ago

—————

REMEMBER: We began WAVE 3 OCT 2020 so all these came within WAVE 3

-

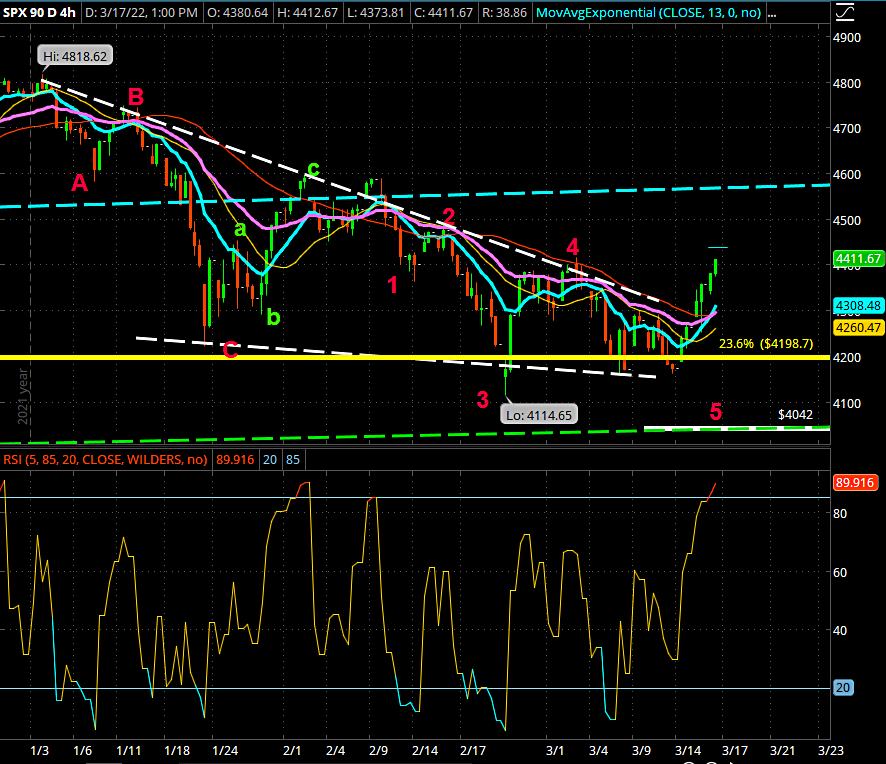

NASDAQ SELL DIVERGENCE on 1Hr; 4Hr OVERBOUGHT

/NQ (QQQ) has gained +9.17% from Tuesday

-

S&P Running sell divergence on /ES 1hr, weak one on SPX 1hr; 4hr OVERBOUGHT

/ES (SPY) has gained +6.66% from Tuesday

MAR 15 & 16 were both GREEN CLOSES

ABOVE the previous close

ABOVE the previous close

FEB 24-25 we did this

(off the FEB LOW FEB 24)FEB 15-16 we did this (producing the OPEX WEEK HIGH Wednesday FEB 16)

FEB 8-9 we did this (when we DOUBLE TOPPED the FEB HIGH @ +4590)

We have just did 3 consecutive GREEN CLOSES

ABOVE the previous close for the 1st time since the 4 (JAN 28 – FEB 2)

ABOVE the previous close for the 1st time since the 4 (JAN 28 – FEB 2)

-

RUSSIA & UKRAINE so here:

You saw headline ping pong for weeks and then yesterday all the BAD HEADLINES get swept under the rug because OPEX comes before RUSSIA & UKRAINE in real life as well as the dictionary

What is Putin’s end game?

Did some research and ONE NUKE would be catastrophic for a 500 km²

Ukraine is 603,548 km²

What is Putin’s end game?

-

VIX

Said many times “I’m not a trend line guy”, but when you draw one of MY LINES and they are to the actual minute, if not second the pivot was created and then see your line come to play on the 1min chart, then I AM a trand line guy

Here’s where that comes from zoomed out:

-

the critical 28.84 pivot will matter later today and DEFINITELY on Quad Witching OPEX Friday tomorrow

-

S&P OPEX PATTERN

NEVER 3 in a row besides that -20% CORRECTION OCT – DEC 2018 that ended wave-3 from the 2009 bottom

SPX MAR HIGH: 4,416.78 (+4p above yesterday’s High)

Definitely possible today to then be the TABLE POUNDING MAR 25/APR 1 PUTS ENTRY ALARM

We’re TOO HIGH TOO FAST HERE (but with the MAR OPEN & MAR HIGH not far off above) and when added in the QUAD WITCHING and standard OPEX Friday (see below):

We’re DUE ONE LAST DIP TO LOW 4200s – HIGH 4100s

Fits BEST for early next week to complete (don’t forget we “peaked” yesterday Wedneday and have been doing that for +1 month now (some Thursday) and selling off into the start of the next week

THEN ITS LONG SPRING/SUMMER into FALL

POST OPEX WEEK PATTERN

FEB 2022:

-

4,489.55 HIGH on Wednesday

-

4,114.65 LOW subsequent Thursday

-

-8.35%

JAN 2022:

-

4,632.24 HIGH Tuesday

-

4,222.62 LOW subsequent Monday

-

-8.84%

DEC 2021 (QUAD WITCHING):

-

4,731.99 Thursday

-

4,531.10 subsequent Monday

-

-4.24%

NOV 2021:

-

4,743.83 Monday after OPEX Week (same fail, but not fail as in NOV 2020)

-

4,585.43 1/2 session after Thanksgiving Friday

-

4,495.12 subsequent Friday DEC 3

-

-3.34% to 4585.43

-

-5.24% to DEC 3

OCT 2021:

-

NONE

-

We began WAVE-5 off the SEP 2020 WAVE -4 drop

-

If you recall, we ran DIPLESS until our famous 4710.80 and into NOV 2021 OPEX

SEP 2021 (WAVE-4 Decline / QUAD Witching):

-

Monday after OPEX Week 1st BOTTOM (4305.91); -3.75% from OPEX Week Thursday Close

-

October 4 – the WAVE-4 BOTTOM (4278.94); -4.35% from OPEX Week Thursday Close

AUG 2021:

-

4480.26 Monday

-

4367.73 Thursday

-

-2.51% within OPEX Week

-

No POST Week dip lower as we went to complete wave-3 of 3 to SEP 2

I can continue on, but the mecahnics are the same

This is a  3.5 TRILLION QUAD WITCHING OPEX SESSION

3.5 TRILLION QUAD WITCHING OPEX SESSION

The largest in history and we’re (chart tenchincals) as ready as ever for a DIP to conclude this CORRECTION and CONFIRM its over with

PUTIN? Charts Alone? Video Game Magic?

Doesn’t matter which, it’s essentially written in stone and then we move back to the regular program of making gaps below we don’t fill and fluff up into SPX 4700s while expecting +5000s into Tome Brady’s final 1st game of the season

ANY tickers you want looked at, PM me in chat

We’re onto session #53 of this CORRECTION and whether this is wave A/1 of the start of the end of the world or its what 9/10 EW’ers have as wave-4 of the Cycle, a large bounce if approaching and we got all the easy meat off the downside back in JAN & FEB

Thus I’d still suspect SPX 4065 – 4050 – 4045 this week / next week for the POST OPEX dip and will remind all:

This is the 3rd consecutive  MONTHLY Candle we’re working via a CLOSE EOM/EOQ below 4,363.14

MONTHLY Candle we’re working via a CLOSE EOM/EOQ below 4,363.14

This will be the 3rd consecutive OPEX FAIL as well via FAILING to reach +4,416.78

——————————

10yr @ 2.162 (5:00 AM EST)

10yr @ 2.162 (5:00 AM EST)

VIX @ 26.30 (5:00 AM EST)

VIX @ 26.30 (5:00 AM EST)

SPX Thursday MAR 17 Data:

SPX Thursday MAR 17 Data:

-

Overnight Gap: -12.75

-

Range: 77.02

-

Open -Close: +66.56

-

Close -Close: +53.81

-

LOD > Previous Close: -22.21

-

Previous Close > High: +54.81

-

ATH > Close: –-8.45%

-

ATH > LOD: -10.02%

-

2022 Open: 4778.14 (-7.67%)

-

HOD Off MAR 2020 LOW: +101.32%

-

YoY: +12.67%

-

Month of March (4,363.14): +1.11%